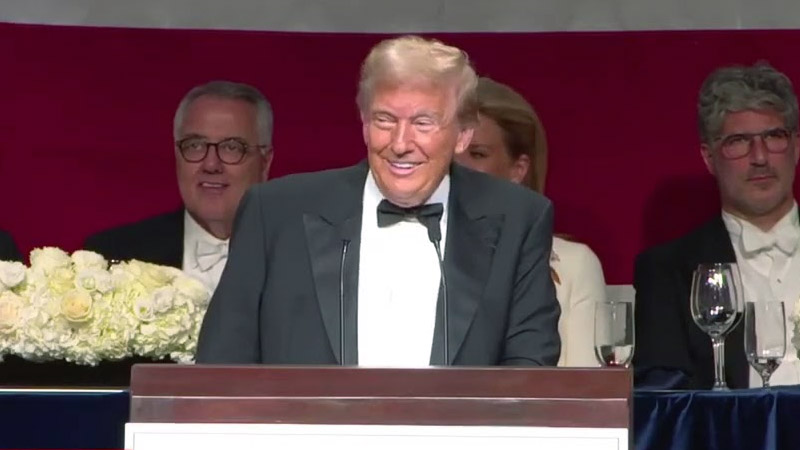

Trump’s Aggressive Tariff Plans Spark Warnings of Higher Prices and Economic Fallout

(Getty Images)

President-elect Donald Trump has doubled down on his plans to implement aggressive new tariffs, sparking concerns from critics and economists. This week, Trump announced his intention to impose a 25% across-the-board tariff on all goods imported from Mexico and Canada, along with a 10% tariff on certain goods from Mainland China, effective as soon as he takes office.

Goldman Sachs has issued a stark warning about the potential fallout from these tariffs, particularly for U.S. consumers. Daan Struyven, head of commodities research at Goldman, discussed the economic implications during a roundtable interview with Bloomberg. “The 25% levy on all products from Canada proposed by Trump would likely raise the price of fuels in the U.S.,” Struyven stated. He added that the move appears reminiscent of tactics from Trump’s first term and might serve as a negotiating tool.

Struyven detailed how the proposed tariffs could negatively impact three key groups: “U.S. consumers, U.S. refiners, and Canadian producers.” Among the most significant risks, he noted, are higher energy and gasoline prices for Americans, stemming from tariffs on Canada—a major supplier of crude oil to the U.S.

The U.S. imports nearly 4 million barrels of Canadian crude oil daily, a vital resource that allows American producers to export more of their own oil. The CEO of the Canadian Association of Petroleum Producers warned that such tariffs would drive up energy costs for American consumers, undermining efforts to maintain lower energy prices.

Struyven acknowledged Trump’s focus on reducing energy costs, speculating that “Canada tariffs are somewhat unlikely” for that reason. However, the uncertainty surrounding these policies has raised alarms across industries reliant on international trade.

The proposed tariffs echo Trump’s earlier trade wars, which were aimed at renegotiating trade deals but often led to higher costs for businesses and consumers alike. Economists caution that the sweeping 25% levy could result in price hikes for everyday goods and increased strain on the energy market.

As the nation awaits the official implementation of Trump’s economic policies, critics and experts continue to express concern about their potential ripple effects. While Trump touts tariffs as a means of protecting American industry, their impact on consumer prices and trade relationships remains a contentious issue.